Trailer Demand & Economic Activity

Trailer Market Demand & Economic Drivers in the U.S.

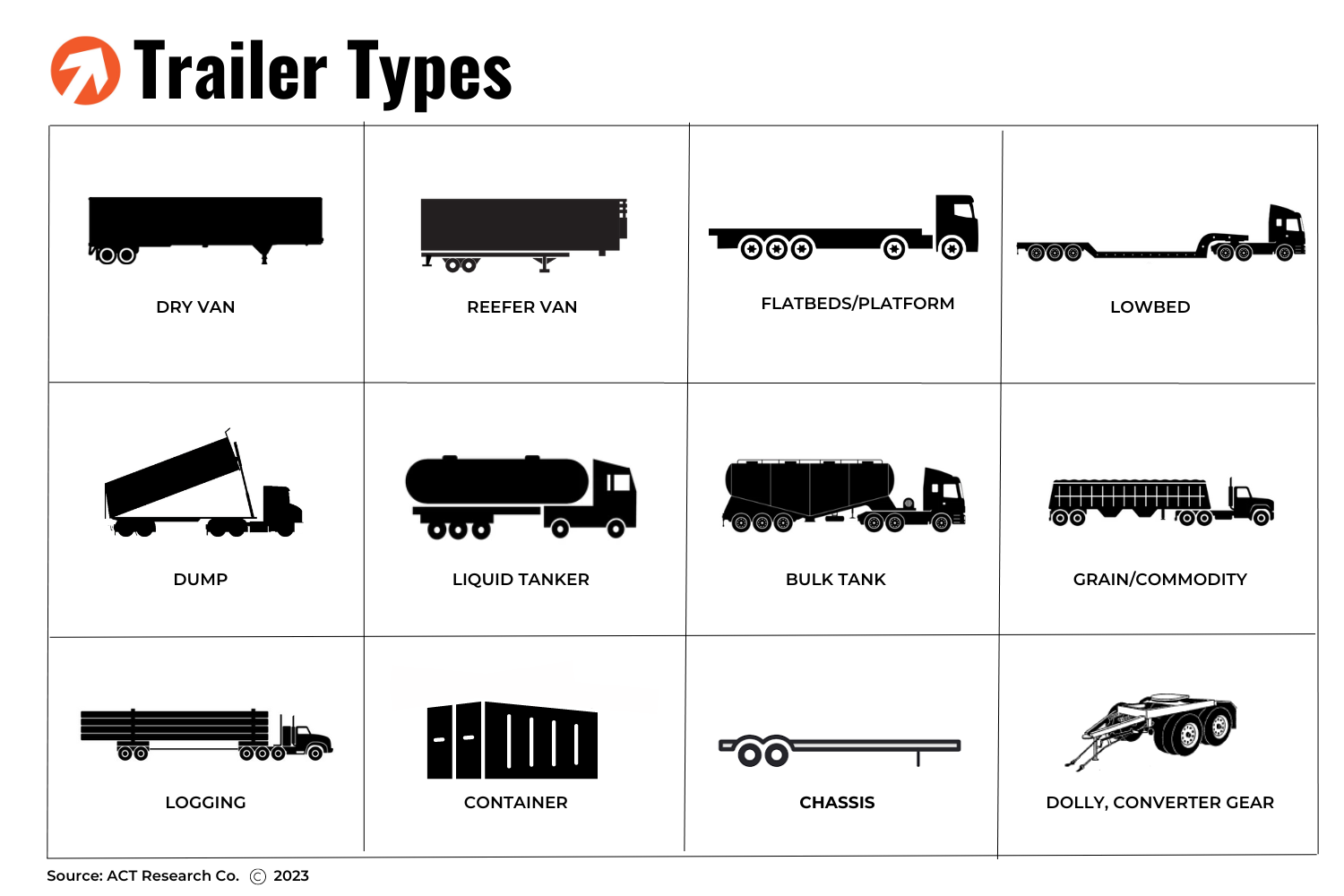

The connection between the trailer market and the economy is evident in various aspects, ranging from the type of trailer to its intended purpose and the target population. This link serves as a compelling and enlightening testament to the interdependence of these two domains.

Dry Vans: Totally enclosed trailer for dry cargo.

Reefer Vans: A refrigerated van trailer. Used for hauling any product that is temperature sensitive, such as food, film, and medications.

Platforms: A trailer chassis consisting of a flat loading deck without permanent sides or roof.

Low Beds: A trailer designed to carry large and heavy loads where loaded height is critical, typically seen moving large construction equipment. MD low bed trailers have a capacity of 25-40 tons, while HD units have a capacity of more than 40 tons.

Dumps: Three types of dump trailers: side, bottom and end. Used in basic industries and construction. Used for aggregates, such as stone, coal and sand.

Tanks: A trailer with a liquid tight vessel to carry liquid or dry bulk freight.

Containers: Containers are the boxes that are used in intermodal service to haul either domestic or international goods. Due to international freight flows, there are no international 20’ or 40’ containers built in North America. The containers produced in the North American market are for domestic freight only and are produced in both dry and refrigerated configurations.

Chassis (aka: container chassis): Chassis are the means by which containerized intermodal freight is delivered from steamships and railroads to customers. A container/chassis combination is basically a two-piece dry van.

Dolly, Converter gear: An auxiliary undercarriage assembly consisting of a chassis, fifth wheel, and tow bar used in combination trailer service.

Many of the factors driving trailer demand are the same that influence Class 8 demand. We encourage you to at least skim the Truck Demand section to gain an appreciation of the macro drivers impacting the supply side of the trailer demand equation.

Demand Composition

Van-type trailers represent the majority of demand in any given year. From 2017 to 2021, dry and reefer vans accounted for more than 75% of all trailers sold in the US. Dry vans represented 61% of production, while reefer vans were 15% of the market. Flatbeds, the third-largest trailer category, averaged 9% of production. The remaining seven trailer categories represent almost 15% of the market.

Freight

There is a straightforward relationship between trailer industry health and economic activity.

Economic growth creates new freight to haul. Adding new freight to the existing pile means more capacity is needed to haul that freight. So, more freight means more trailers, improved productivity within the existing trailer fleet, or a combination of the two.

Economic downturns reduce freight volumes, putting downward pressure on new equipment demand and potentially delaying replacement demand as well.

Overcapacity is a new vehicle market killer that typically coincides with an economic slowdown or even contraction. Those slowdowns tend to occur after a freight cycle that has helped put large amounts of new equipment into operation, irritating the situation.

Because trailers are typically purchased in multiples relative to Class 8 tractors, Class 8 tractor and driver supply are the key reasons for equipment over- and under-capacity relative to freight to be hauled. So, even if your interest is exclusively in the trailer realm, we encourage you to maintain a strong awareness of US tractor market activity.

While economic activity determines the number of new trailers needed for the population to accommodate new work, replacements are needed to continue hauling already existing freight flows.

Population and Fleet Age

During the past decade, robust trailer shipments triggered a strong upward surge in the US trailer population. This generated a corresponding drop in the average age of that fleet. A young fleet allows truckers more leeway in their equipment buying decisions.

Dry Van Population

After massive growth through the 1990s, the US dry van fleet posted only modest growth in the early 2000s, before plateauing in 2006/2007 at 1.83 million units. There were four drivers of the sharp population run-up in the 1990s:

national adoption of the 53’ trailer standard,

the move from Fiberglass-Reinforced Plastic (FRP) to aluminum plate and composite sidewalls,

the advent of just-in-time (JIT) inventory management, which triggered a sharp run up in trailer-tractor ratios, and

aggressive original equipment manufacturer (OEM) market share wars into the end of the 1990s.

The flattening in the market across the first decade of the new century was attributable to two factors:

Market overcapacity into 2000

Electronic trailer tracking technology, which allowed for fleet rationalization and meaningfully lower van trailer-to-tractor ratios

From its 2006 peak, it took 12 years and 22% GDP growth before the dry van population reached a new high in 2018. In the meantime, population bottomed in 2012 at roughly 1.62 million units, down 215,000 units, or 12%, from 2006. 2022 will close with a dry van population of 2.05 million units, up 67k from 2021. While there is a high degree of variability in the short to medium term, ACT’s modeling shows a strong rule-of-thumb relationship between the trailer population and US GDP growth over the long term, at a roughly 2:1 ratio.

Average Age

Strong demand for new trailers has had the opposite effect on average fleet age since 2013. As the population rose, fleet age fell. At the end of 2019, the average age of the dry van population was 6.8 years, the lowest since the 2000’s identical reading. Fleet age ticked up to 6.9 years in 2020 and will trend to 7.3 years in 2027. A younger fleet implies little pent-up demand and ease with which to defer replacements.

Ratios

For dry vans, a trailer-to-tractor ratio is another consideration for future demand. Following the introduction of trailer tracking devices in the early 2000s, the ratio has remained lower versus the 1990s. Every basis point of change is equal to around 2,200 units of population.

Looking forward, our model anticipates a rise in the ratio in the medium term, from 2.6:1 to 2.9:1. The rise is due to increased warehousing resulting from e-commerce growth that increases drop-and-hook type operations, as well as elevated tractor retirements. On the flip-side, tracking technology and packaging productivity continue to evolve, arguing for increased utilization levels which would dampen the ratio from reaching even higher ratios long term.

Underlying Replacement

Dry van replacement rates peaked in 2014, trended down through 2021, before starting a long upward swing in 2022. Replacement activity peaked in 2014, completing the mass-extinction cycle of all of the trailers sold in the second half of the 1990s. Past volume is a precursor to future demand. Underlying demand will push to 140,000 units by the end of the current decade because of the 2013-2019 market strength.

Fleet Quality

Let’s take a second look at the quality of the fleet by examining the late-model population relative to the active population. In this example, we are looking at the percentage of van trailers sold in the past nine years relative to units sold across the past 18 years. We wrestle with whether 9/18 or 8/16 is the better measure in dry vans, but due to a smoother pattern, we favor the older comparison.

Similar to average fleet age, the fleet quality metric helps us understand the current demand for trailers.

In 2019, the percentage of late-model equipment in the fleet rose to an all-time high of 62% versus a long-run 53% average. While there was a strong argument to be made for elevated demand through the course of the past decade, examining the fleet in this manner suggests it will be easier for truckers to defer purchases during the forecast horizon, if times get tough.

Reefer Van Population

Reefer van population and age show there is a greater degree of predictability in reefer van demand than for other trailer types. Stability comes from an underlying demand for temperature-controlled freight movement, primarily food and dairy products. This tends to buffer cyclical swings as well as some unique traits that make reefer vans the shortest-lived of all trailer types.

The average age of the reefer van fleet remained in a tight 5.4- to 6.4-year band from 1980 to 2021. Not surprisingly, over those 40+ years, the age of the fleet has averaged 5.94 years. At the end of 2022, the average age of the fleet will reach 6.0 years, up slightly from 2019, which was the lowest fleet age in the past 20 years and the third lowest on record. Reefer van age is impacted by four factors integral to temperature stability:

Insulation foam breaks down over time, reducing thermal efficiency.

Insulation absorbs moisture over time, reducing freight capacity, thermal efficiency, and vehicle efficiency.

The trailer box itself can become compromised.

The reefer unit wears out.

When a refrigeration unit replacement is considered for a very old trailer, the business model normally shows it’s not worth putting a new unit on an inefficient box. Old reefer vans tend to live out their lives as temp-controlled or stand-alone dry storage.

There were two key drivers of new reefer van demand through the course of the twenty-teens:

- California Air Resources Board (CARB) Transport Refrigeration Unit (TRU) regulations mandating a late-model/clean-diesel reefer fleet.

In 2010, CARB mandated a seven-year age threshold on a rolling basis. “Evergreen” units were added as a reefer power alternative mid-decade. There is a steady drumbeat of CARB TRU regulations hitting the calendar (almost) annually over the next several years. Starting in 2023, all new reefers operating in California will be powered by electricity when stationary. By 2027, the entire reefer fleet must be shore-power compatible.

- Implementation of Food Safety Management Act (FSMA).

The FSMA pulled volumes forward in 2014-2017. New equipment helps fleets meet regulatory requirements regarding safe transportation of food for both human and pet consumption, including temperature control, sanitary conditions, and the documentation of those efforts. Between CARB TRU regulations and the FSMA, the industry is amid a major run up in underlying replacements for reefer van trailers.

Flatbed Population

As the US economy has transitioned from manufacturing-intensive to service-based, the flatbed market has stalled. The change in the economy’s footing is illustrated in the compound annual growth rates (CAGRs) of flatbed and reefer van trailers. For flatbeds, the growth rate over the past three decades has been an anemic 0.7% compared to the reefer van market’s 3.3% CAGR. Examples of economic sectors driving flatbed demand include steel output, automobile production, and new home construction. The relatively modest growth in the flatbed fleet over the past 30 years aligns with the slow decline in US steel output over that period. Thanks to the lack of flatbed trailer sales from 2001 to 2010, and the best five-year sales period on record from 2015 to 2019, fleet age declined to a 20-year low of 6.8 years in 2019. This compares to an average fleet age of 7.5 years in the 1990-2022 period.

The US trailer market is dominated by dry and reefer vans and flatbed trailers. In the five years ending 2019, those three trailer types comprised 85% of US trailer demand.

The remaining 15% of the market consists of mission-specific trailers, directly impacted by the specifics of the job they were designed to accomplish. Dumps, low beds, and bulk tanks are driven by construction, road building, mining, and oil exploration. Sanitary-grade liquid tanks can be found hauling loads of fruit juice or milk, while other liquid tanks are built to haul chemicals and various petroleum products. Hydraulic fracturing has been a major driver of bulk and liquid tanks with those segments’ fortunes tied to the price of oil. Ag sector profitability is the driving force for grain trailers.

Trailer OEs

According to the 2022 Trailer Output Report by Trailer Body Builders, the top 25 North American truck-trailer OEMS and their 2022 trailer sales are below:

Hyundai Translead - 63,206

Wabash - 51,090

Utility - 50,023

Great Dane - 40,000

Stoughton - 24,750

Vanguard National - 20,563

Pitts Trailers-Dorsey Intermodal - 11,104

Fontaine - 9,182

EnTrans - 8,107

MAC - 7,628

MANAC - 7,450

Fruehauf North America - 5,821

XPO Logistics - 4,705

Timpte - 4,473

Reitnouer - 3,401

Dorsey Trailer - 3,217

Kentucky Trailer - 2,601

East Manufacturing. - 2,425

Premier - 2,318

Trail King - 1,800

Strick Trailers - 1,700

Di-Mond - 1,432

Felling - 1,401

Tremcar - 1,184

Doepker - 1,163

Looking for current trailer market data?

ACT Research publishes a monthly report on the current state of the U.S. trailer market, covering the 12 trailer types noted in the graphic above.

The majority of trailer OEMS submit market indicator data to ACT. We aggregate the data by segment in our reports and provide it back to the market to help provide insights into the health of the current market. Below are those market indicators.

MARKET INDICATORS

Backlog (BL): The backlog is the number of vehicles that have been ordered but have not yet been built. Backlog is calculable: Past backlog + current net orders – current build = new backlog.

Build (BU): Build, or production, pertains to the number of vehicles produced for a given market, NOT the country in which the actual production takes place. When a unit leaves the assembly line it is counted in the build data.

New Orders: New orders are the total number of orders received by the industry each month. Also referred to as gross orders.

Cancellations: Cancellations are units that have been ordered previously and are then canceled. Order and cancellation cannot occur in the same month.

Net Orders: New Orders – Cancellations = Net Orders.

Inventory: Inventory is the number of units that have been built, but for which no factory shipment has yet taken place. Inventory is a calculable number, rather than an additive, number: Past inventory + current build – current factory shipments = current inventory.

Factory Shipments (FS): Units that have been built and have left the factory.

Market Indicators

The market vitals that measure the health of the industry are what we call market indicators; those metrics allow OEMs, suppliers, investors, dealerships, and fleets to understand and plan for the next phase in the cycle and beyond.

Secondary Market, Primary Focus

The sale of used commercial trucks is critical to the overall health of the commercial market. It supports the smaller fleets and owner-operators to maintain higher-quality equipment standards and keep the movement of freight flowing across the nation's highways.

Resources

Whether you’re new to our company or are already a subscriber, we encourage you to take advantage of all our resources.