Driving Automation

Automating Commercial Vehicle Fleets

As autonomous commercial vehicles (ACVs) enter the transportation market, there will be a massive surge in productivity. Who will bear the brunt of this surge? Drivers, manufacturers, and suppliers of CVs, if only for a time. Once AVs deploy and efficiency gains materialize, sales volumes will likely decrease through the 2030s. But productivity is a good thing....

Class 8 Tractor Demand Impact

In economic terms, if productivity grows 1% per year, it will take 72 years to double a nation’s standard of living. At 2%, 36 years. A massive surge in productivity, indeed, burdens some segments of the transportation system. But, it benefits others, like shippers and fleets. It also benefits the broad economy. Truck-borne freight transportation will, at the very least, become disinflationary, if not deflationary.

A 1% improvement in productivity theoretically means you need 1% fewer trucks in the fleet to do the work. A 20% improvement in tractor-specific productivity means the US economy should be able to get by with around 20% fewer tractors by 2040.

Autonomy requires us to rethink acceleration of wear and vehicle life cycle. Today, most high-service fleets trade their trucks between 400K and 500K miles. Depending on the niche, for-hire or private, those mileages build up from around four to six years. The decision to trade at a young age is not based on the truck no longer being able to haul freight. Rather, it is because trucks begin to lose the ability to make deliveries at the high-service levels required by fleet customers. It is also based on rising service downtime and increased operating costs. With autonomy, the importance of vehicle uptime will be high. Out-of-service events will be even more expensive. But, we assume a truck driven by computers will enjoy a longer “first life,” roughly 600K to 750K miles, than those driven by humans.

ACT's total-cost-of-ownership (TCO) model anticipates a rapid increase in autonomous demand starting around 2029. The three-year-old autonomous fleet will rise from around 100k units to 350k by 2032. And from there, we will see a gradual acceleration to around 465k units by the end of 2040. At that level, AVs represent nearly 21% of the tractor fleet and right at 15% of the total fleet by 2040.

An autonomous second life for AVs is not assumed. But there will be plenty of drayage-type opportunities in the transfer-hub model. A vehicle traveling 50 or 100 miles, rather than 500 or 1,000, is easier to operate in less time-sensitive freight sectors. And, a broken truck 25 miles away from home is easier to service than one that breaks 250 miles from its destination. Because of the rapid turnover out of what we are referencing as the “first-life” fleet, there is an equally rapid accumulation of no-longer-fit-for-primetime, “second- life” vehicles which are autonomously capable and may or may not continue in autonomous operations. The “second-life” autonomous fleet, using a six-year moving average, will be roughly equal in size to the “first-life” fleet at around 430k units. Combined, AVs will total nearly 900k units, less scrappage.

In building our new vehicle estimates, we focused on productivity as a one-time impact on demand. Once we move past the period of major autonomous productivity gains, we would expect to see Class 8 demand normalize to levels not dissimilar to the current relationship between economic activity and new vehicle demand.

Total Available Market

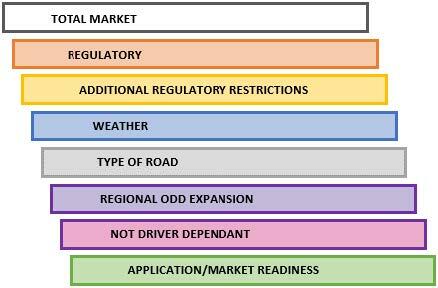

There are several factors to consider when determining the total available market (TAM) for autonomous commercial vehicles (ACVs). There are restrictions that prevent 100% substitution of a traditional CV with an ACV. By using vehicle miles traveled (VMT) and a multi-step approach to restricting the market, ACT Research has identified and quantified the potential available market.

Methodology

The Department of Transportation (DOT) and the Federal Highway Administration (FHWA) track highway VMT data at the state level. The data separate interstate and non-interstate miles and define the percentage driven by “truck” (tractor, straight, and bus). With these data sets, ACT Research has delineated the VMT by interstate and non-interstate roadways, for every state, by truck type. To get to the final potential market sizing, ACT Research has taken a multi-layered approach through rounds of “cuts”. The TAM covers seven qualifying criteria against the total CV sales for each year of the study. This depiction of the available market defines the basis used for calculating the projected number of ACV units for each application in the total cost of ownership (TCO).

Regulatory

The first cut of the available VMT is based on regulations. There are states with regulations that allow ACV operations and states that do not regulate ACVs at all. We assume for this first cut that ACV operations would be permitted if there is no regulation at all (as long as federal guidance is followed). This is the broadest cut and technically the TAM—any new truck in a state where regulations (or total lack of) would allow operation of ACVs.

Additional Regulatory Restriction

Though a state doesn't currently regulate ACVs, doesn't also mean ACV deployment might occur in that state. Most operations will begin in states that explicitly allow ACV deployment. In this second cut, any VMT state that does not regulate is removed.

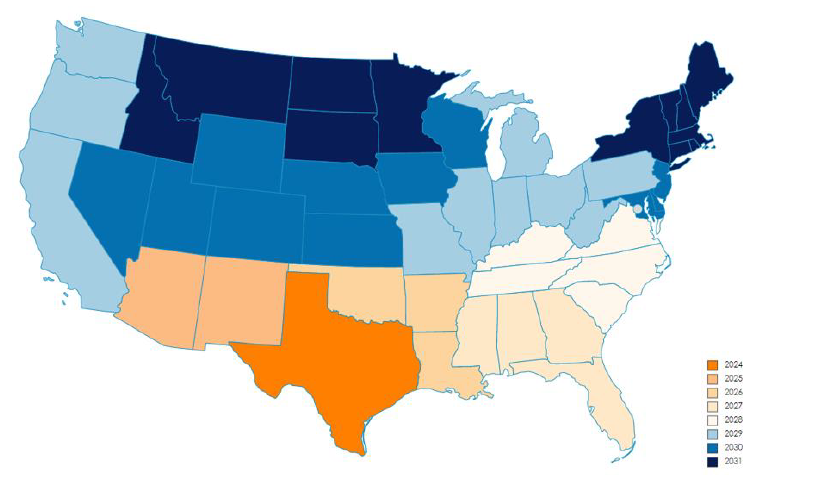

Without federal preemption, the patchwork of state regulations will continue to change as more states decide to tool their own path forward with Level 4 ACVs. The following map is a prediction of how more states may phase in regulations to allow for deployment and operation of ACVs over the coming years. Several factors determine a state’s readiness or willingness to pass regulations: safety concerns, labor unions, weather conditions, public opinion, economic impact, desire to regulate, or desire for the least amount of regulation possible. This map proposes only one potential expansion scenario of more state regulations.

Weather

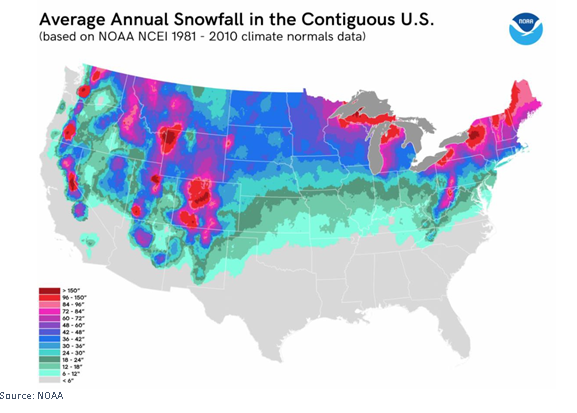

The third cut takes inclement weather into consideration. It's not a coincidence ACVs begin deployment in the south. The modifications to accommodate cold weather issues are currently in development. Regardless of technology and hardware required to handle inclement weather, drivers may need to perform non-driving tasks related to weather conditions. A truck driving through a snowy mountain pass may need chains put on the tires, a task required of the driver. For this cut, we used average snowfall data from the National Oceanic and Atmospheric Administration (NOAA).

Type of Road

In this next cut, we recognize the operational design domains (ODDs) for different ACVs will lean towards different types of VMT. Class 8 tractors will be running interstate miles in the early years (we assume any non-interstate VMT will be negligible). Straight trucks will be a mix of both types of VMT. Buses will be restricted to non-interstate VMT only.

Regional ODD Expansion

This fifth cut considers the roll-out and expansion of the ODD. The initial VMT considers deployment states, and then phases in extra routes and states over the course of the timeline of this study. In this cut, the scope and expansion of heavy-duty (HD) mapping aligns with more traveled freight corridors. Before a route is included in the ODD, HD mapping must occur to define that particular roadway.

This operation is a strategic step in ODD expansion considerations. Once ACV operations are at scale, HD mapping can continue, utilizing trucks in operation and providing ongoing updates. The ODD expansion predictions in ACT's study focuses on freight corridors that experience the most truck volume. This consideration assumes autonomous operations will prioritize launching in more traveled freight corridors.

The state of Texas would be the initial area for deployment starting in 2024. ODD expansion progresses next to include Arizona and New Mexico in 2025. Oklahoma, Arkansas, and Louisiana will follow in 2026. The study assumes a regular cadence of ODD expansion, such that by 2031 ODD constraints will include all 48 contiguous states.

Not Driver Dependent

In the sixth cut, we do not make any additional changes to the available VMT. We recognize deployment of ACV operations will restrict a certain percent of the available market, as it will always need a driver. For regional and long-haul applications, hauls containing hazardous materials, livestock, precious cargo, household moves, extra-wide loads, and some drayage, will continue to require human drivers. Flatbeds hauling equipment will need a driver due to regulations requiring ongoing, periodic checks. In 2035 and 2040, ACT restricts the available market and holds back 20-25% for both regional and long-haul Class 8 tractor-trailers as a result.

Local delivery box truck, less-than-truckload (LTL), linehaul, and local truckload (TL) applications include a percentage considered “high touch” and will need a driver compared to regional and long-haul. Because of this, ACT restricts the available market by withholding 60% of the market until 2040 when the restriction loosens. We expect conditions will change as the industry shifts some of the non-driving tasks a driver completes and assigns them to other local resources. By 2040, 40% of local delivery box truck, LTL, linehaul, and local TL applications will still need a driver.

Construction, refuse, and transit bus applications are all less compatible with autonomy. As such, those applications are restricted to

dump trucks operating in confined construction sites with fixed regular routes and

limited industrial activity more adaptable to automated dumpster pick up in restricted facilities and locations.

Residential garbage collection has not been considered for autonomy and has been withheld from the available market. Transit bus applications considerations hold for limited routes and applications. Transit bus application in this study is for Class 8 transit buses only.

Application/Market Readiness

ACT holds back in the early years of the study timeline on the likelihood of when each application will begin to adopt automated driving systems (ADS) technology. In the early years of the study, long-haul applications driving interstate miles are prioritized. Local delivery box truck, LTL, linehaul, and local TL applications remain restricted until 2028. Refuse and construction applications delay until the end of this decade. Transit buses remain restricted until 2035.

ACT also considers the possibility of the industry being able to accommodate and meet the changing needs of ACVs. This includes factors such as supply-chain capacity expansion for AV specific components, route planning and scheduling, as well as infrastructure needs including technicians and a network of long-haul transfer hubs.

Looking for analysis and forecasts on autonomy?

Driving Automation: Commercial Transportation's Pursuit of Level 4 Autonomy

How will autonomous commercial vehicle technology be adopted, where, and when? These are questions the entire market is asking; most have theories and guesses, but what does the math say?

Autonomous Commercial Vehicle Market

Economic Factors Driving Adoption of ACVs

The motivation behind autonomous commercial vehicles (ACVs) goes beyond convenience. There are five main categories for economic savings of a vehicle’s total cost of ownership (TCO):

Increased equipment utilization

Improved delivery times

Improved fuel economy

Improved labor productivity

Improved safety / accident reductions

Increased Equipment Utilization

The ability to operate a truck over a 24-hour period (the ACT Research TCO model assumes 20 hours/day) increases use of a CV. Typical hours-of-service (HOS) requirements limit drivers to 11 hours/day with mandated rest periods before resuming driving. An autonomous truck is not restricted by HOS requirements, as there is no driver behind the wheel. This enables a fleet owner to increase use of the truck and provides a faster payback on the initial vehicle investment.

Improved Delivery Times

The ability to operate a truck without HOS requirements supports shorter delivery times. Perishable items can be delivered with less risk and cost of spoilage. Companies can reconfigure locations and the number of distribution centers for 24-hour delivery demands. Incentives for shorter turnaround times will yield premium rates. Over time, shorter delivery times will most likely become standard, causing longer delivery times to be less acceptable.

Improved Fuel Economy

The ability to control the vehicle at a modulated speed, with improved forward perception to anticipate evasive maneuvers, provides improvements to the vehicle’s fuel economy. The percentage of fuel economy improvements varies by the vehicle’s operating environment and duty cycle.

Improved Labor Productivity

Utilizing drivers on shorter, drayage-type routes for first- and last-mile operations, and less on long-haul operations, will improve labor productivity. Longer hours and the inability to return home at the end of a day’s work have become less desirable for individuals entering the workforce. This has resulted in increased turnover rates. – For-hire carriers are experiencing turnover rates of nearly 90%. There are fewer available drivers in the workforce, and the phrase “driver shortage” has become all too common. Keep reading to learn more on how drivers will be impacted by autonomy.

Improved Safety

Anticipated safety improvements and accident reductions of ACVs promise to ease some of the most common causes of truck accidents. According to data compiled by the Federal Motor Carrier Safety Administration (FMCSA), driver error causes over 60% of accidents involving medium-duty (MD) and heavy-duty (HD) trucks. ACVs do not have human-error issues such as drowsiness, distracted driving, sleep apnea, speeding, or misjudging the speed of other vehicles. The ACT Research TCO model assumes reductions in both insurance costs and claims paid, once there is adequate performance data available to confirm the promise of improved safety and reduction of accidents.

Historical Perspective

Understanding the origins and timeline of autonomous vehicle (AV) development helps show it is not a new concept. In 1478, 544 years ago, Leonardo da Vinci toyed with the idea of a self-propelled cart. For context, internal combustion engines (ICE) weren’t invented until 1876, 398 years later. The cart performed through coiled springs and had steering and braking capabilities. A programmable steering mechanism made of wooden blocks arranged behind gears allowed the vehicle to steer straight or turn at pre-set angles.

Francis P. Houdina, an inventor, staged demonstrations during the mid-1920s of his radio-controlled car, the “American Wonder.” Often referred to as the “Ghost Car" or the moved through an operator in another car traveling behind. That operator controlled braking, steering, and stopping functions. A demonstration of the “American Wonder” took place in the summer of 1925 in New York City. The vehicle operated well until the radio signal connection failed. The “American Wonder” crashed into a car filled with spectators from the press. Houdina, encouraged to move past this mishap, refined his invention and continued to showcase it at various events across the US. While there seem to have been no more accidents, remote radio-controlled vehicles evolved as a novelty and used to publicize safe driving into the early 1930s.

While German physicist, Heinrich Hertz, conceived the basic idea of radar in the late 1880s, serious developmental work began in the 1930s. Approximately 25 years later, in the early 1960s, Hughes Aircraft developed the system that became the basis for LiDAR (Light Detection and Ranging). By the mid-1980s, self-driving prototype vans underwent testing at universities and automotive companies' research centers. In 1995, two researchers from Carnegie Mellon University (CMU) completed a 2,850-mile road trip in a 1990 Pontiac minivan “driven” autonomously. For 98.2% of the trip, the minivan was driven by RALPH, the Rapidly Adapting Lateral Position Handler. This autonomous driving system had been under development at CMU for many years.

The US Defense Advanced Research Projects Agency (DARPA) challenges held in 2004-2007 marked the turning point in automated driving systems (ADS) advancement. The US military held an interest in developing self-driving ground vehicles at 15-20 miles per hour. They established a deployment goal for 2015. The "Grand Challenge," the initial DARPA event, was held in March 2004. It was the first long distance competition for driverless cars in the world and boasted a $1 million prize. This was the first time DARPA introduced a contest with a monetary award as a means to encourage inventors and innovations. The 142-mile course stretched across the Mojave desert, from Barstow, CA to Primm, NV. Only 15 out of 106 teams competed beyond elimination, and only four managed to survive beyond a few hours.

The CMU team progressed the farthest at 7.4 miles before getting stuck executing a hairpin turn. While this initial event didn’t produce a winner, it did achieve DARPA’s goals to “accelerate autonomous ground vehicle technology development in the United States in the areas of sensors, navigation, control algorithms, vehicle systems, and systems integration.”

DARPA then announced a second Grand Challenge for October 2005 with the grand prize doubled to $2 million. The race was again held in the Mojave desert, but this time the course covered 132 miles beginning to end in Primm, NV. There were 195 teams, compared to 106 from the 2004 event. There were 43 semifinalists and 20 finalists. The four top teams from 2004 returned, with some new entrants including Stanford and Oshkosh. In all, only five teams were able to complete the course, with Stanford winning. This second Grand Challenge demonstrated technical feasibility of autonomous driving along a specified closed course, over rugged terrain, and with obstacles.

Many of the early pioneers who competed in the DARPA Grand Challenges founded active AV companies today. Chris Urmson, from the Carnegie Mellon team, went on to found Aurora. Sebastian Thrun, leader of the Stanford team, started Google X.

Michael Montemerlo, also from the Stanford team, is now at Waymo. Dave Hall, leader of the Digital Auto Drive team, is now at Velodyne. And Michael Fleming, leader of the Virginia Tech team, found TORC.

The DARPA challenges catapulted those who became the AV industry players in existence today.

ACV: Market Overview

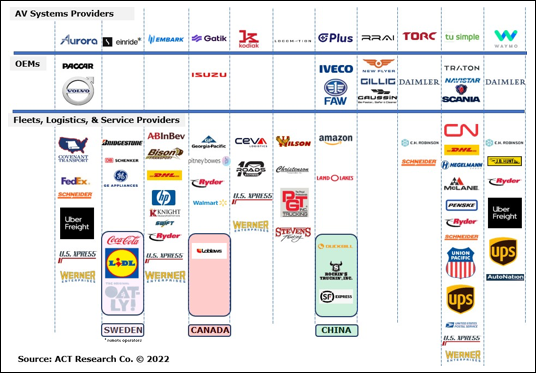

The autonomous commercial vehicle (ACV) market comprises the traditional original equipment manufacturers (OEMs), fleet operators, and logistics providers, along with the addition of AV system providers and the AV system component suppliers.

The accompanying graphic depicts the key players and alliances as of September 2022.

Beyond designing and producing autonomous trucks, other partnerships have been established that focus on service and maintenance operations. As with today’s maintenance and servicing of conventional driver-in trucks, maintenance and repair of AV system components will be carried out by technicians trained by the AV system providers and OEMs. Ryder has announced partnerships with Embark, Gatik, TuSimple and Waymo, focused on providing service and maintenance support at ACV transfer hubs, and in some cases on-the-road support as well. TuSimple is also partnering with Penske for over-the-road service and preventive maintenance for ACVs. Kodiak is partnering with Pilot Company (Pilot and Flying J truck stops) to provide service and maintenance at designated truck stops serving as transfer hubs.

In addition to alliances and partnerships with OEMs, larger sized fleets and logistics providers are collaborating with AV system providers, as indicated in the graphic on the previous page. As an indicator of interest in autonomy, fleets currently want to understand benefits, technology readiness, and expected launch timing and roll-out considerations.

ACV Market: AV Systems Providers

The AV systems providers in the commercial vehicle space are for the most part, focused on commercial vehicles as their sole target for commercialization. Of the eleven firms described in the above table, only three have targeted additional market segments beyond CVs. Aurora is working on introducing their ADS technology, called “Aurora Driver,” for the passenger vehicle space with “Aurora Connect” which is focused on autonomous ride-hailing. Robotic Research has been developing autonomous vehicle technology since 2002, with an initial focus on the military – in 2010 their unmanned vehicles were deployed in Afghanistan to clear roadways of IEDs. They have expanded into commercial vehicle applications through the establishment of RR.AI. Waymo, which is the autonomous vehicle subsidiary of Alphabet, started back in 2009 as the Google Self-Driving Car Project with a focus on passenger vehicles, in 2020 Waymo Via was launched as the trucking division of Waymo.

There are several business model strategies that have been adopted by the AV systems providers. They run the gamut from the AV company owning the trucks outright and hauling freight and charging a per mile rate, in essence becoming a dedicated for-hire carrier themselves, to providing the AV systems suite of hardware and software to an OEM and charging a per mile rate subscription fee. There are a few firms – Kodiak and TuSimple – that will adopt a hybrid business model, both providing the AV system and charging a per mile fee, AND owning ADS trucks and hauling freight. A few others have stated that in the initial launch years of commercialization, they will own the trucks and haul freight, very similar to today’s field-testing scenarios, but their intentions from a long-term perspective is not to create a separate freight carrier group within their company.

ACV Commercialization and Deployment Considerations

Other important considerations for the launch of autonomous commercial vehicles (ACVs):

how the AV systems will be specified and installed,

whether these systems will be available for retrofit, and

how tasks typically performed by a human driver will be executed.

Individual AV system providers will design, supply, and control the complete AV suite. The integration of the AV system, and the required redundancy to the vehicle, will restrict the breadth of options for a given vehicle platform. While the AV system suppliers are designing their systems to be more or less vehicle agnostic, there are considerations for integration into the vehicle.

SAE Level 4 AV systems would only be sold for integration into new trucks, and would not be available as an aftermarket retro-fit option. Retro-fitting would create uncertainty, difficulty certifying as-new in performance, and too much risk. But AV systems themselves are being designed for modularity and ease of repair and replacement.

Trained specialists will monitor and provide high-level guidance, as well as remote assistance, for AVs. ACT Research's total-cost-of-ownership (TCO) model shows the ratio of specialized monitoring for each truck will decrease over time. These monitors are for tele-assist, and are not intended to control the vehicle. They will handle potential route changes, adverse weather conditions, and other situations the AV may encounter. Initially, the AV system providers will help support this remote monitoring function, but the expectation is that this monitoring function will live within the fleet. The current role of a fleet dispatcher will transition into this remote monitoring function. This would also extend to some form of integrating fleet management software into the routing and monitoring of the ACV. There are some AV systems designed to have 100% remote-controlled vehicles.

The industry is currently considering accommodations for vehicle inspections and law enforcement interventions. Today, the driver handles pre-checking the truck and trailer. With an autonomous truck, a digital pre-check with a final check-off by a human at the truck’s departure location is the expectation. This may change over time to enable a combination of digital inspection reports with remote oversight.

ACVs tested on the road today have simulated maneuvers to accommodate if/when a truck might need to pull over for law enforcement. In addition, there are scenarios being developed to respond to situations when an autonomous truck may need to pull over. How will triangles or road flares be deployed without the help of a human driver? How will roadside assistance be summoned? How will vehicle inspections be handled, and information transmitted as required? These are questions the ACV community is addressing. Solutions will develop as AV deployment moves from pilot and field testing to full-on commercialization.

Deployment of ACVs will alter how fleets manage their routes and trucks. State restrictions and operational design domain (ODD) expansion in the early years of AV launch will complicate how fleets use ACVs. As ACV adoption grows, fleets will maximize their investment and use ACV capabilities to the fullest extent. They will determine which routes are best suited for ACV deployment. And they will manage the mix of autonomous and driver-in trucks. The expectation is that straightforward, less complicated routes will be the first to deploy ACVs. The ability to do a longer length of haul in a shorter elapsed time will change up routing and scheduling. Modifying long-haul routes from dock-to-dock to a transfer-hub strategy will add complexity to scheduling first- and last-mile driver-in tractors. This will drive a redesign of freight operations and a change to existing logistics software. ACT predicts that by the next decade, ACVs will be more commonplace, especially for long-haul and regional applications.

ACV Second Life Considerations

For the most part, fleet buyers today buy and hold a truck for approximately five years, sell the truck into the secondary market, and upgrade to newer models with updated technology and features. This trade cycle is based on many factors including existing warranty coverage, increasing costs of repairs and maintenance, vehicle uptime degradation, and the condition of the truck, including repairs to cab interiors.

This approach is expected to change with the implementation of autonomous vehicle (AV) technology. Fleets will tend to hold onto an ACV longer than a conventional truck, in part to maximize the payback on the initial higher investment. The expectation is that an autonomously driven truck will be driven in a more regulated, modulated manner, with less wear and tear on the truck. Less wear and tear on the interior cabin, mirroring the frequency of actually being driven by a human driver, will be minimal. Some fleets may opt for a faster trade cycle to get that latest technology. The expectation is that improvements and upgrades will be available for ACVs over their useful life, though there could eventually be some limitations.

But eventually, even with the expectation of longer life and the ability for AV system upgrades, the ACV will be traded out into the secondary market. And what will that secondary market be for a previously owned autonomous truck? Trucks should be designed and developed for flexibility to enable use either as an ACV or a conventional driver-in.

Second-life autonomous trucks can still drive autonomously. AV systems would still be checked and certified to be in proper working condition. The AV system providers would continue supporting the hardware and software under a transferred contract with the new owner. System upgrades would still be available to that second owner. The second life of an ACV could just as easily convert to a driver-in use, with the AV system becoming disabled and no longer serviced or supported by the AV systems providers. Because the truck will have been designed to still accommodate driver-in operation, the second life can revert to driver-in, most likely used in local haulage for first- and last-mile types of haul.

Policy and Regulations

Regulations play a critical role in how the adoption of autonomous commercial vehicle (ACV) technology will develop. Federal regulation(s) are anticipated and desired. At present, there is no overarching federal regulation that permits SAE Level 4 autonomous testing and/or operation. Instead, it is currently left to individual states to decide if and/or how to regulate ACV activities in state. We are left with a patchwork of state regulations on ACVs.

As more states have allowed ACV testing and operation over the past few years, there is concern and curiosity over how the US Department of Transportation (DOT) will approach regulation. The hope by most is to have one guiding set of regulations to provide certainty for a developing market. The most serious concern for many stakeholders is that federal regulators could decide to restrict, to some degree, the ability to operate ACVs.

Impact on Drivers

While increased safety is a top selling point for ACV advocates, labor disintermediation (cutting out the middleman, i.e., the driver) will be the incentive for fleet ACV adoption. Why? Labor is the major operating cost bucket. If a trucking company can materially lower hours, they should be able to inversely raise profitability.

This section provides a statistical and anecdotal overview of trucking with a view from the cockpit. To understand issues surrounding drivers, we will examine how we got here, how things are changing, and what autonomy means for drivers in the future.

On retention, not all driving jobs are equal. By offering more home time and better pay, the private fleets and LTL segments enjoy lower turnover rates (15%) vs for-hire fleets. Due to the age and experience of private fleet drivers, a larger number of their turnover is from retirements, rather than dissatisfaction.

In the long-haul segment, the average large for-hire trucking company had an 89% turnover rate in 2021. The average fleet had to replace nearly all its workforce over the course of the year. Closer to reality, fleets are more likely replacing the bottom 20% or 25% of their driver labor force around four times per year.

The “driver shortage” is a persistent industry complaint. At its root, employee churn is continuous. Most of the industry’s labor challenges are a retention problem. “Driver pay shortage” is a better descriptor during periods of weak freight activity. “Driver quality of life shortage” is a persistent refrain for a hard and often lonely job. Neither are inconsequential factors.

We recognize hiring and retaining drivers is a top problem, and concur with most if not all the causes cited:

Driving is a difficult and sometimes dangerous job.

Driving can lead to an unhealthy and undesirable lifestyle (excessive time away from home, poor health habits and diet, confined workspace).

Work status/prestige is low relative to other lines of work.

New technologies (ELDs, speed restrictions, tracking technologies) bring management monitoring and control into areas that had before been at the driver’s discretion. This is a big negative for drivers who value independence.

Regulations narrow the labor pool and/or are hurting driver productivity.

CSA safety scores “stick” to the driver.

Follicle-level drug testing.

Health and sleep apnea screening.

Hours of Service.

Demographics: The current driver population skews to the “baby boom” generation. We will see disproportionate (compared to other industries) driver exits as these workers near 65.

A driver shortage is – ironically – a sign of prosperity for the business. After all, it is the amount of freight that determines driver demand (not the reverse), and freight is a manifestation of economic activity. When the economy accelerates, the industry does well and the driver problem rises to the top of the management worry list.

Given trucking was in its infancy back in 1914, the driver shortage is as old as the industry. It's an evergreen phenomenon. Sensational headlines about driver problems (turnover, recruitment, and retention) are always high during freight inflection points with snail-speed driver additions. “Driver shortage” was a buzz phrase in 1994, 1999, 2004-2005, 2014, 2018, and 2020-2021, but not so much in most other years. Periods of shortage during freight turning points drive margin peaks for carriers.

Despite “trucker” being among the most common occupations in the US, according to the Bureau of Labor Statistics (BLS), the industry continues to report a shortage of 80,000 drivers, and the shortage is only going to get worse. ACT takes an alternative view: it is not the number of drivers that determines how much freight will be hauled, but rather, it is the amount of freight that determines the driver population required to deliver the freight. As freight volumes ebb and flow, the need for drivers changes depending on where we are in the freight cycle.

Being a truck driver is a hard job, with low compensation relative to work performed, status and pay received, and by other quality-of-life metrics. Lifestyle issues such as long hours and time away from home, infrastructure problems like lack of parking, long detention times and unpaid hours of work, high risk of injury and health problems, an ever-increasing regulatory load to include increased hours of service (HOS) regulations, electronic logging devices (ELD), and the introduction of the FMCSA Commercial Driver’s License Drug and Alcohol Clearinghouse are some of the reasons for the driver shortage.

More than a shortage of bodies, the driver “shortage” is one of retention. Employers continually (and expensively) need to find new prospects due to all of the issues above. While there are shortages of drivers, there are plenty of people in the US who hold a Commercial Driver’s License (CDL). It has been estimated that there are over two CDL holders in the US for every active driver today.

Driver Demographics

According to a report by the American Trucking Associations (ATA), the typical trucker is 46 years old, nearly 10% higher than the economy-wide 42 year average age in the US. Segments of the trucking industry that have higher average ages are those that pay for experienced drivers, less-than-truckload (LTL), and private fleets. The skew toward older drivers is leading to a higher number of retirements.

Currently, the average age of a new driver trainee is 35 years old. In 1994, only 11% of the driver workforce was 45 or older. By 2021, that demographic made up 30% of drivers.

Women only make up 7.8% of the trucking workforce, despite making up a total of 47% of the US workforce. This could be attributed to an unaccommodating work environment and unequal pay, among other things.

The most common ethnicity of commercial truck drivers is White (63%), followed by Hispanic or Latino (18.1%), and Black or African American (13%).

US Population and Labor Force

The US population only grew 0.1% in 2021, the lowest rate since the nation’s founding. The slow rate of growth connects back to decreased net international migration, decreased fertility, and increased mortality due in part to the COVID-19 pandemic. COVID-19 contributed to minimal population growth, but growth was slowing before the pandemic.

Since the post-WW2 baby boom that triggered a surge in the US population, overall growth rates have been shrinking. The recent census showed from 2010-2020, the US registered the second-lowest decade of growth in its history.

In the absence of bodies, productivity-enhancing solutions will be a critical factor in the economy’s ability to grow at healthy rates and continue to expand US living standards.

Labor Force Impacts

Autonomous operations will come at the expense of long-haul driving jobs. Labor cost savings are likely to be the primary factor on which most fleets will choose autonomy over driver-in operations. There will be fewer driving jobs in the future relative to freight to be hauled, particularly in long-haul. Beyond driver employment, there will be winners and losers in the service jobs that support freight operations across the interstate system.

We take issue with those who suggest there will be no net impact on drivers over the long term. Trucking employment in long-haul applications in 2040 will be anything but a shadow of its pre-autonomous self.

Labor gains: Depending on technology, there will be a new layer of truck operation managers to monitor the fleet and take over remotely when the situation requires. There will need to be emergency techs strategically positioned in the field for trucks needing in-person assistance when en route. While these jobs will spring up, they are technical in nature and will draw employees from different labor pools relative to the path most take to truck driving.

Labor losses: We are not focused here on the impact of autonomy on non-driving jobs throughout the logistics chain. Those in small towns along freight corridors who work in businesses surrounding and servicing truck stops are likely to see their livelihoods reduced. These rural losses may be at least partly offset by gains in service operations around major transfer hubs.

ACT Research’s estimate ranges from almost 560k fewer truck driving jobs in 2040 to nearly 700k fewer jobs.

The next, and final, section of The Wheels of Commerce continues the conversation on drivers and discusses ACT's perspective on the perennial "driver shortage" problem.

Charging Forward

Decarbonizing commercial transportation has become one of, if not the most critical, objective for OEMs, suppliers, fleets, and national governments. The last 5 years have seen massive growth and investment in this effort; what will we see in the next 5?

Resources

Whether you’re new to our company or are already a subscriber, we encourage you to take advantage of all our resources.