Charging Forward

Decarbonizing Commercial Vehicle Fleets

When historians identify the point at which commercial vehicle (CV) electrification changed from concept to reality, they will point to the current period.

Commercial Vehicle Decarbonization Targets and Goals

Since the Paris Agreement of 2016, CV original equipment manufacturers (OEMs) and fleets have supported moving to cleaner emissions standards and meeting zero-emission goals across the globe. Through those efforts, OEMs have publicly stated their product commitments on a timeline to meet the net-zero goals for 2050 as set at the Paris Agreements in 2016.

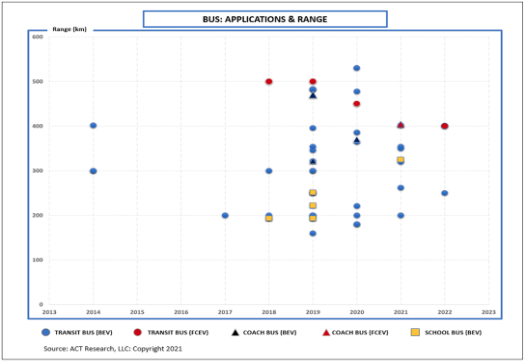

Since then, almost every legacy global OEM, as well as new-entrant OEMs, has introduced at least a concept electric vehicle (EV). Some have even gone so far as buying a stake in a battery producer for supply chain bargaining power. As early as 2010, vehicle makers began making battery electric vehicles (BEVs) in the bus segment. By 2015, they added trucks. The earliest CEVs were typically buses and return-to-base delivery vehicles with lower gross vehicle weight ratings (GVWR). After several years of designing and testing, the majority of OEMs are ready to launch production vehicles with higher GVWRs.

Comparing Decarbonization Power to Diesel ICE Power

Fleets are planning for their future, reviewing multiple considerations during the decision-making process that will impact business long-term: duty cycle/application of the vehicles in your fleet, fueling/charging infrastructure, incentives and subsidies, and regulations and timelines to meet them. That's a lot of boxes to check. Where do you start?

Because of the nature of our work, we're continually focused on forecasting the demand for commercial vehicles over the next 5-20 years. With that focus, we've dived into not only the long-term demand for commercial vehicles but what powertrain those vehicles will have and what the adoption rates for decarbonization vehicles will be at different applications over that timeframe.

There are several key considerations to review when looking at this aspect of the market from a strategic planning and total-cost-of-ownership (TCO) perspective:

- Economics

- Market Overview & Technology Advancements

- Regulations & Subsidies

- Infrastructure & Fueling/Charging

- Payback Period

Economics

The economics of freight won't change because of new powertrain opportunities. However, some key, long-term known unknowns should be considered when looking at the future of decarbonization and meeting zero-emission goals.

- Global Geopolitics: The pandemic and trade tensions have shown how easily global manufacturing supply chains can break. This was especially clear in 2021, when the pandemic caused production failures and disrupted supply chains. When supply chains are in bad shape, it's hard for basic industries to keep up with the demand. To the extent manufacturing "reshoring" and "friend-shoring" occur, the trend will benefit domestic commercial vehicle demand as manufacturing is a major source of truck freight.

- Autonomy: The introduction of commercial autonomous vehicles (CAVs) in the freight industry has the potential to increase productivity greatly. Currently, regulations restrict drivers' work hours. However, if a portion of the trucking market becomes automated, productivity could double in certain industry segments. While this surge in productivity is expected to benefit the industry, it may also lead to a decrease in new vehicle demand as the fleet adjusts to the changes. On a positive note, autonomous technology is most effective in long-haul heavy-duty markets, which typically have higher costs for BEVs.

- Regulatory Impacts: Europe is taking the lead in reducing carbon emissions worldwide. However, not all countries are moving forward with the same determination. Some countries, like the U.S., are slower in making commitments to address climate change, while others have made vague commitments without clear actions.

Market Overview & Technology Advancements

From legacy OEMs to new entrant OEMs, there have been considerable efforts across the Classes 4-8 segment to develop various battery, fuel cell, natural gas (NG), hydrogen internal combustion (H2 ICE), or hybrid powertrains to provide a solution to meet zero-emission goals. The charts below profile vehicles currently in serial production and available today, and indicate the application's maximum range and the Start of Production date.

BEVs offer the most efficient solution when compared to ICE and fuel cell electric vehicles (FCEVs):

Battery Electric

Fuel Production Efficiency: 95%

OVERALL Efficiency: 73%

Fuel Cell H2

Fuel Production Efficiency: 64%

OVERALL Efficiency: 29%

Diesel ICE

Fuel Production Efficiency: 50%

OVERALL Efficiency: 23%

Duty cycles, environmental conditions, and more determine overall efficiency. The data above shows an average best-case scenario, but ACT recognizes these powertrain efficiencies can also be expressed in ranges. Expect improvements made over time.

Hydrogen fuel cell technology has also moved forward as a strong decarbonization contender. But the business case for fuel cells is further out on the horizon than batteries, which are viable today. Battery electric power works well for shorter ranges and stop-and-go operations.

Hydrogen-powered electrification is recognized as the longer-term solution for longer-haul heavy-duty (HD) applications. The central focus of hydrogen adoption cases is on cost, accessibility, and greenness of the fuel.

Secondary challenges to hydrogen? Potential technology breakthroughs in battery pack range and energy density. Improved technologies could put battery over hydrogen in longer length-of-haul applications.

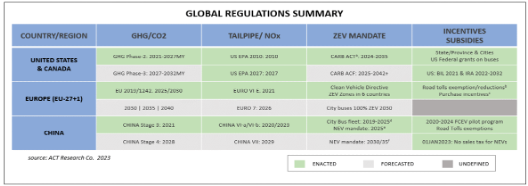

Government regulations and policies will influence CEV volumes. ICE regulations will increase their costs. GHG/CO2 regulations will require some level of electrified propulsion. Policies will provide incentives and subsidies to CEVs. Zero-emission mandates will require some targeted percentage of CEV/FCEV adoption. Tougher regulatory standards for ICE will lead to a more favorable TCO for CEV. Encouraged buyers will move toward CEV alternatives.

Battery-electric powertrains have certain strengths favorable to vehicles with duty cycles that have:

Intermediate daily ranges,

Lower-speed operations,

Highly regular routes,

Stop-and-go driving profiles, and

Return-to-base for overnight charging.

Regulations & Subsidies

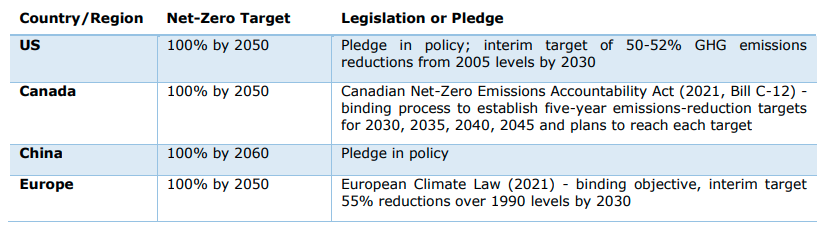

191 countries and the European Union committed to addressing long-term climate goals in the Paris Agreement in 2016. Many countries are working on strategies to reduce their emissions; some have set targets for achieving net-zero emissions. Currently, 119 countries have taken steps to establish net-zero targets, but only 18 of them have turned these targets into laws. Net-zero targets of key global areas include:

Around the world, regulations, subsidies, and incentives have influenced and will keep affecting the market for CVs until 2050. Not all countries have the same strictness for reducing CO2 or tailpipe emissions, and they don't all have the same deadlines or requirements for ZEVs. However, regulations play a major role in pushing the world to use commercial vehicles that don't produce emissions, specifically greenhouse gas (GHG) and CO2 emissions, NOx and tailpipe emissions, and ZEV mandates.

Infrastructure & Fueling/Charging

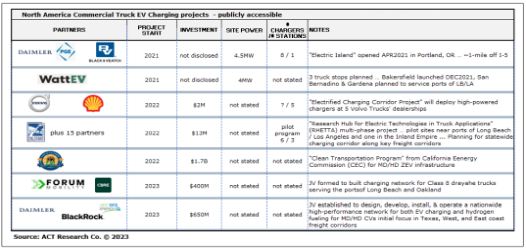

Two questions summarize concerns about infrastructure: will there be enough electricity-generating capacity to serve the incremental demand for electric vehicle charging? Will it come from "green" sources? Big questions are to be answered, but OEMs, other infrastructure suppliers, and charging companies have engaged in projects and initiatives to provide the necessary tools to meet these needs for the transportation industry.

In North America, the duty cycle of almost 75% of commercial vehicle applications operates as "return to base," which is well suited for charging during off-shift hours. Class 8 tractor sleepers and approximately 5% of the Class 8 tractor day cab do not return to base, while school buses, refuse trucks, utility vehicles, and work trucks typically operate on a single shift, leaving the remaining hours available for charging while the vehicle is parked at the depot. This brings us back to our two questions about infrastructure. Will the grid support the incremental demand and be "green" if 75% of applications can be charged?

What about the long-haul, Class 8 tractor market? Various initiatives, like the National Electric Vehicle Infrastructure (NEVI) program, provide funding to states to deploy EV charging stations and establish interconnected networks to facilitate data collection, with the goal of creating a nationwide network of 500,000 EV charging locations along major highways and throughout American communities to support and enable long-distance driving.

Payback Period

Truckers and fleets of various types buy trucks to make money. Trucks are an integral tool for beverage delivery companies, electricians, refuse companies, and long-haul fleets. So, the economics of the vehicle purchase has to work out in favor of the fleet over time. When reviewing when and how a fleet will measure the total cost of operating trucks or buses from a powertrain perspective, there are several factors to consider:

- Regulations & incentives

- Initial purchase costs

- Fuel and emissions fluids

- Maintenance costs

- Insurance costs

- Charging infrastructure investments

- Road usage taxes for zero-emissions trucks

- Battery replacement

- Fuel cell replacement

- Taxes

- Weight/function factor

ACT Research has developed a total-cost-of-ownership (TCO) model that calculates these and additional factors to support the complete analysis of payback and how companies can develop a strategic business plan to achieve zero-emission goals set in Paris in 2016, meet national regulations/mandates, take advantage of subsidies and incentives, and still provide their service without causing significant financial hardship to their bottom-line.

The development of decarbonization options has been one of the primary focuses of the commercial vehicle market since 2018. Since then, we've seen new entrants and legacy businesses work to develop options and opportunities that drive decarbonization.

Secondary Market, Primary Focus

The sale of used commercial trucks is critical to the overall health of the commercial market. It supports the smaller fleets and owner-operators to maintain higher-quality equipment standards and keep the movement of freight flowing across the nation's highways.

Driving Automation

The next significant advancement in commercial transportation is the opportunity to create greater efficiency through autonomous technology. The path to SAE Level 4 autonomy is fraught with regulatory, insurance, weather, application, and more challenges, but the payoff for fleets could be significant once in place.

Resources

Whether you’re new to our company or are already a subscriber, we encourage you to take advantage of all our resources.