According to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report, end-of-2025 challenges remained on the horizon as the trailer industry entered 2026.

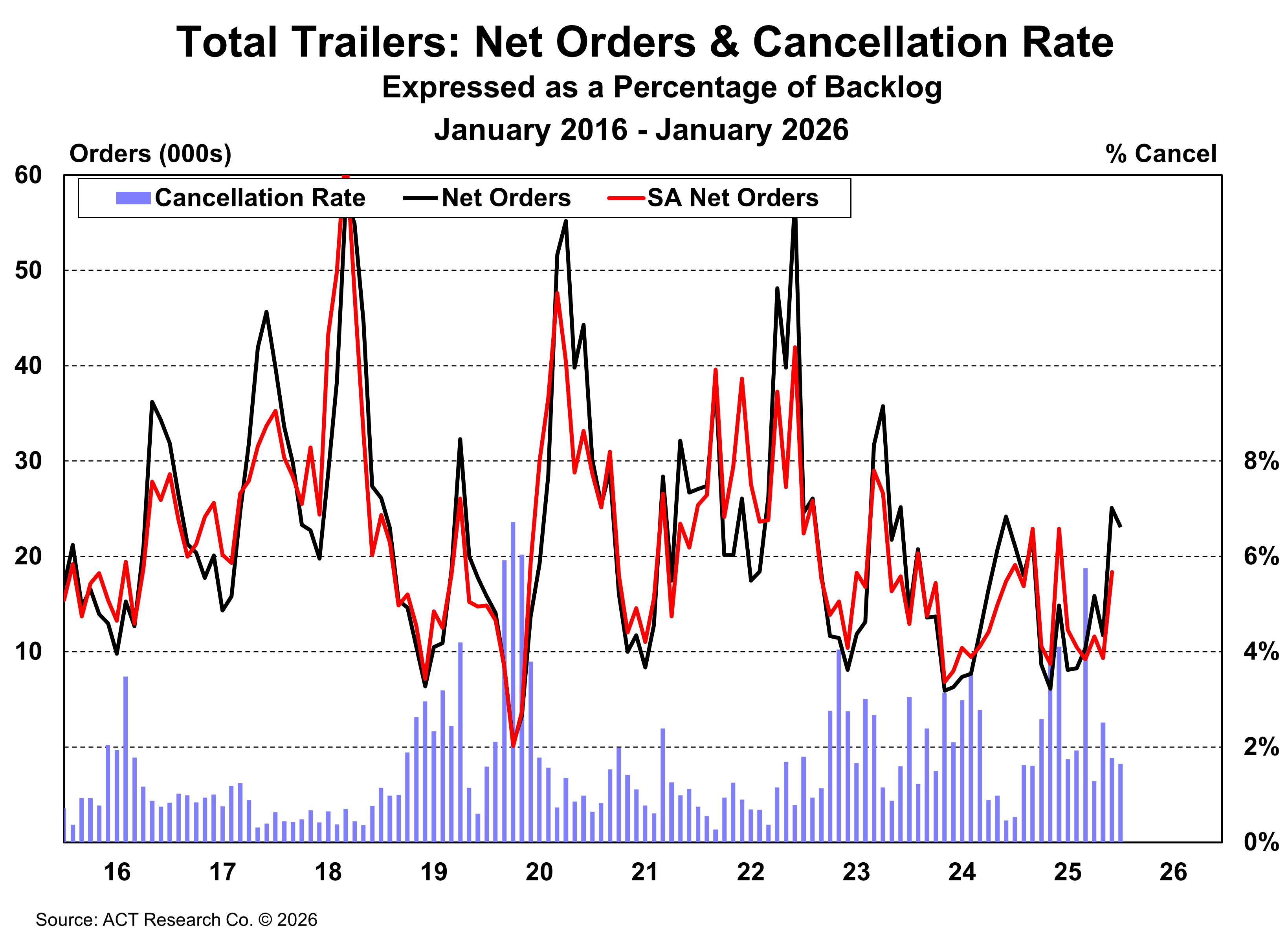

“Cancellations gyrated between earth and outer space through most of 2025, before returning to a more subdued rate, 1.8% as a percentage of backlog, in December. The new year opened with a still elevated but more stable 1.6% rate in January,” said Jennifer McNealy, Director–CV Market Research & Publications at ACT Research. “Data continued to show elevated cancellations in the dry van and tank segments.”

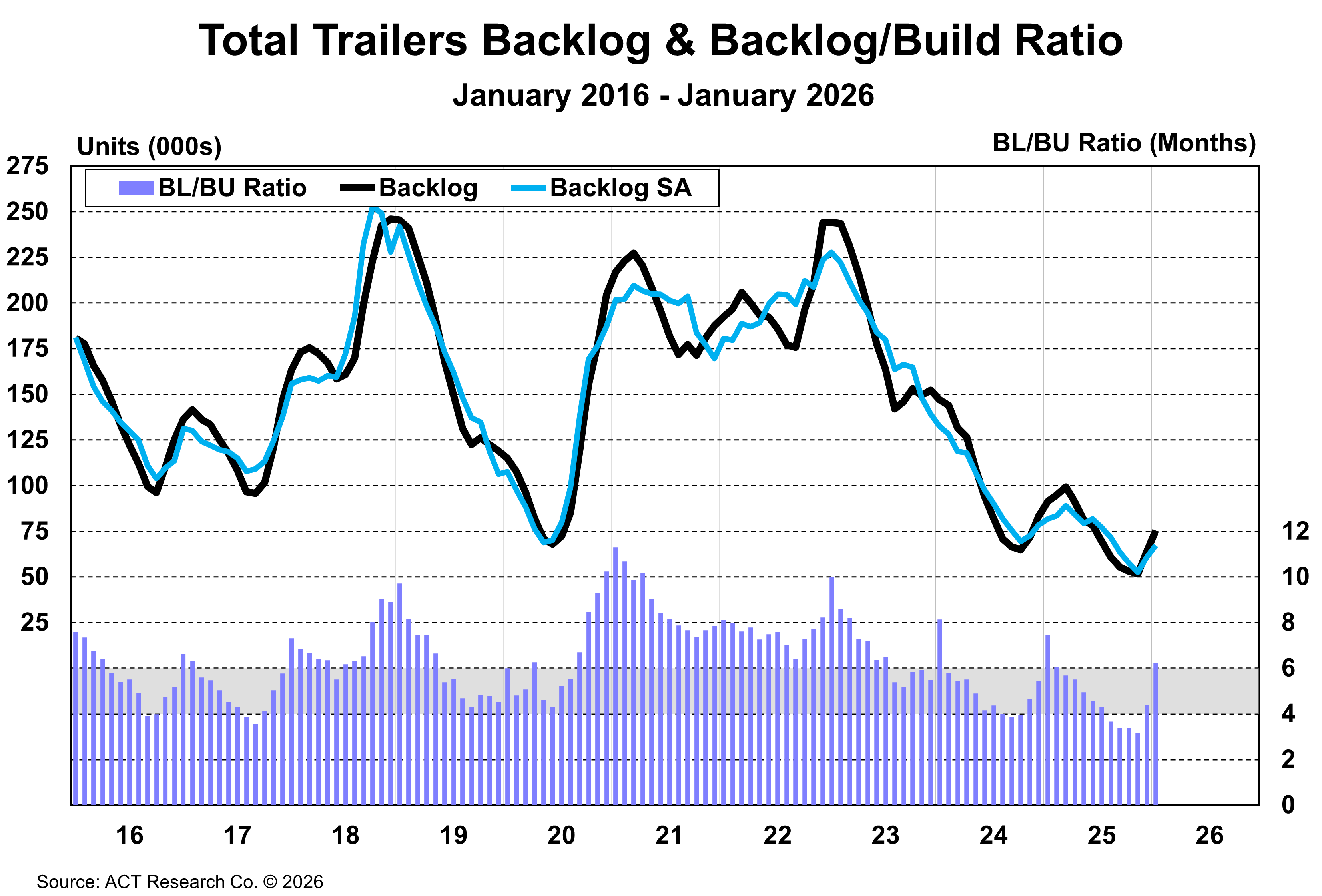

“For a second consecutive month, net orders significantly outpaced build, pumping some life into the anemic backlogs on the books through most of 2025,” McNealy continued. “Backlogs rose more than 18% sequentially, or about 12k units, ending January at 75,500 units.”

McNealy concluded, “As we move into 2026, the trailer industry faces relatively weak demand/order activity, financing concerns, tariffs known, the uncertainty of tariffs to come, weak carrier profits and still low freight volumes, in a period of constrained capital spending balanced against high input costs. However, the uptick in net orders the past two months has built the backlog queue and given industry leaders reason to believe that 2026 could be the year of transition that everyone has been hoping to have.”

State of the Industry: U.S. Trailers Report Overview

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis, and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Preliminary net trailer orders in January were down about 2,000 units from December’s 25,100-unit level, an 8% month-to-month decrease. At 23,000 units booked in January, order intake was more than 9% above January 2025’s level. Seasonal adjustment (SA) at this point in the annual order cycle lowers the monthly tally to 19,700 units. Final January trailer industry data will be available later this month. This preliminary order estimate is typically within ±5% of the final order tally.

“Sequentially, a drop in net orders was expected, as December is usually the second strongest order month of the annual cycle,” said Jennifer McNealy, Director CV Market Research & Publications at ACT Research. “January is usually the month when trailer makers begin to take fewer orders and start to work down the backlog that grew during the peak of order season, October through December. That said, fleet decision-making hesitance into late 2025 seems to have delayed the cycle a bit, causing January orders to follow the traditional pattern but still surprising on the high side, as December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are in play for trailing equipment demand.”

McNealy concluded, “The questions now become how sustainable are 20k-plus-unit order intake months, and how quickly will trailer OEMs build down the still-thin backlog, particularly given concerns about the level of activity in the key freight generating economic sectors that drives transportation demand, still-weak, although improving, for-hire carrier profitability, and uncertainty about future government policies that remain as challenges to stronger trailer demand in the near term.”

- Cancellation Rate as a % of Backlog: 1.6%

- Backlogs: 75,500 units

Click here to learn more information about ACT's State of the Industry: U.S. Trailers.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.

Save time with ACT Research’s media kit. Access ACT Research’s analyst bio, logos, press releases, video library, and more at your convenience. Our analysts are committed to delivering the most accurate data and forecasts. Looking for a speaker? Each analyst is available to speak at your conference or event. Access Media Kit Here.