Booming economic activity results in more freight needing hauled. Freight volume refers to the amount of goods, import and export, moving through the transportation industry. Almost every physical product made or sold in the U.S. economy moves through the commercial vehicle (CV) market.

Why Is Freight Volume Important?

No matter the economic environment, having an understanding of market trends is extremely valuable for companies to be able to respond to challenges and opportunities.

Shippers own or supply the goods (freight) that carriers will transport, and brokers act as the middle man between them; thus, the amount of freight moving among these players will impact how they conduct their business. Businesses benefit from having accurate information related to freight volume so they can better plan for the road ahead.

An effective way to think about supply and demand in the truckload (TL) market is the concept of a pendulum. When demand grows faster than capacity and the supply of drivers or tractors is short, the pendulum swings to the fleets and freight rates rise. When supply growth outpaces demand growth, the pendulum swings to the shipper and freight rates fall. Trying to match long-term businesses with short-term fluctuations in freight demand is cyclical.

How is Freight Volume Measured?

For any company, the scope of internal data can be limiting and unfortunately, the cost of gathering broader market analysis can be prohibitive. As a solution, ACT Research gathers information on a confidential basis from a wide variety of TL carriers, especially the small and mid-size TL carriers that haul a major portion of freight in the North American market. The elements of information include:

- business volume trends,

- market price trends, and

- expectations for vehicle sales and purchases.

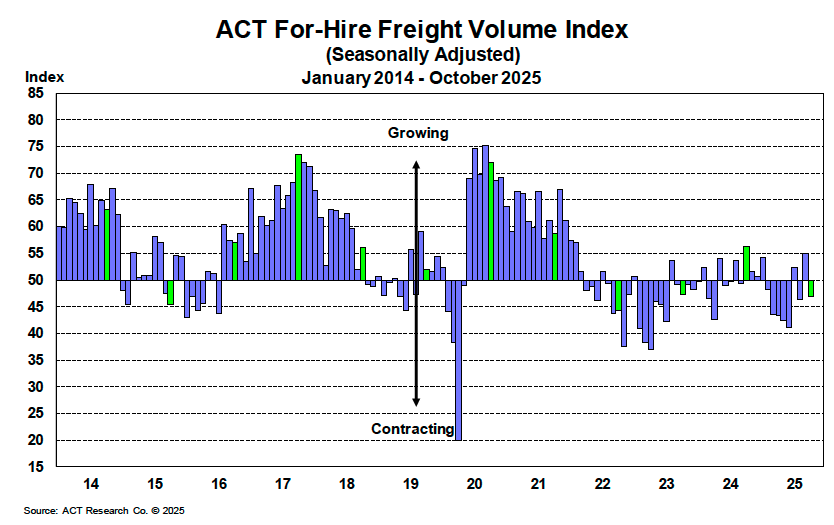

The ACT For-Hire Trucking Index surveys carriers to help paint a comprehensive picture of trends in transportation and CV markets.

Additionally, ACT Research partners with Cass Information Systems, Inc., the nation’s largest processor of freight billing, to gain insight on current market trends and the state of the shipping sector. ACT uses the Cass Freight Index®, which measures freight volumes and expenditures, and the Truckload Linehaul Index®, a pricing indicator, to forecast freight demand.

What is ACT saying right now about freight volume?

Updated Freight Volume Overview – December 2025

Freight volumes remain weak as of December, with no clear indication of a sustained rebound heading into year-end. The temporary lift from pre-tariff shipping has fully unwound, and the market is now firmly in a payback-driven phase. According to the latest ACT Research data, for-hire freight volumes remain largely flat, with activity showing little net improvement over recent months. Despite early signs of capacity contraction, excess supply and muted demand continue to cap volume recovery across most major segments.

Retail-oriented freight remains the primary drag on improvement. Consumer spending has moderated further, pressured by high borrowing costs, lingering tariff-driven inflation, and increased household caution. Retailers continue to operate with lean inventories and conservative replenishment strategies, limiting freight tied to restocking. While e-commerce volumes remain relatively resilient, they have not been sufficient to offset weakness in general merchandise, discretionary goods, and bulky durable categories.

Intermodal activity softened further into late 2025. The reversal of pre-tariff import demand is now fully flowing through containerized volumes, with intermodal shipments declining year-over-year. Rail service performance has improved and port congestion has eased, but aggressive truckload pricing and ample highway capacity continue to limit modal conversion. Intermodal spot rates remain under pressure, constraining margins and dampening near-term growth incentives.

Industrial-oriented freight remains under strain. Manufacturing output continues to show little momentum, and factory orders remain soft, limiting freight tied to machinery, components, and industrial inputs. Construction activity remains bifurcated: public-sector infrastructure freight is providing a modest floor, while private residential and commercial construction remains weak. Energy-related freight has also softened, influenced by policy uncertainty, uneven capital investment, and slower drilling activity.

Looking into late Q4 2025 and early 2026, risks remain skewed to the downside. ACT Research does not expect a traditional holiday freight surge, noting that consumer demand remains selective and inventories are already positioned conservatively. While winter weather disruptions have created short-term volatility, they have not altered the broader demand trajectory. Carriers continue to emphasize cost discipline, network optimization, and operational flexibility to manage ongoing softness.

With pre-tariff paybacks lingering, imports and industrial activity subdued, and freight-generating sectors lacking momentum, overall freight volumes are expected to remain stagnant into early 2026. ACT Research anticipates that any meaningful stabilization is more likely to emerge seasonally in the spring, supported by ongoing capacity contraction rather than a near-term demand rebound.

Freight Volume Forecasting

When forecasting the truckload and less-than-truckload markets, ACT Research utilizes two primary metrics to measure industry volumes (demand):

In short, both measure consumer demand that drives the shipping of goods by a carrier. In other words, measurements of the volume of freight hauled.

Cass Freight Index®- Shipments measures the number of freight shipments hauled within North America by Cass Information Systems. Cass processes more than $44 billion in freight transactions annually and is the ideal source for measuring shipper volumes.

ACT Freight Composite Index is a measure of the estimated total freight hauled by sector as developed by ACT Research.

These two demand metrics provide insights into the expected volumes of freight shipped over the next 6-36 months, providing a supply-demand balance when utilized with ACT's capacity (supply) metrics.

To see how freight volume is likely to change in the future, and for detailed analysis and forecasts for truckload, less-than-truckload, and intermodal, see ACT's freight & transportation forecast.