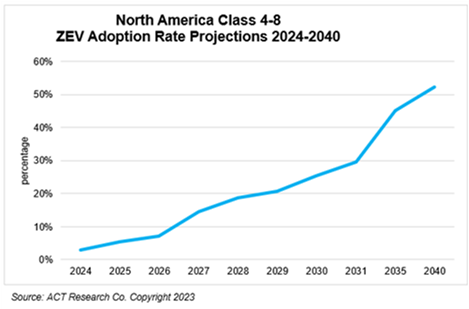

According to ACT Research’s recently released edition of CHARGING FORWARD, a multi-client decarbonization study of the US commercial vehicle market, the adoption rates for zero-emission and decarbonization vehicles will reach 25% by 2030 and 50% by 2040. Regulations are a key factor in the earlier years, particularly for higher GVW applications, while many lower GVW applications already provide a better total cost of ownership (TCO) today.

“We forecast a relatively low adoption rate from 2024 through 2026, reflecting the fact that BEV sales of commercial vehicles are still in their early years,” noted Ann Rundle, Vice President of Electrification & Autonomy with ACT Research. “This begins to change in 2027, in part due to the cost increases for diesels because of the increased stringency of US EPA’s 2027 low-NOx regulations. In addition, by 2027, eight states will have joined California in adopting Advanced Clean Trucks, resulting in moderate growth in adoption rates.”

By 2030 ACT Research is forecasting 25% adoption rates, as by then the remaining nine states that signed the MOU to adopt CARB Advanced Clean Trucks will have enacted those regulations. Additionally, it is assumed that improved battery technology will negate battery replacement costs, and charging infrastructure utilization will significantly increase, decreasing those costs in the TCO.

Rundle concluded, “By 2040 we are forecasting that adoption of ZEVs will account for just slightly above 50%—essentially half of all CVs will be zero emissions, primarily BEVs.”

CHARGING FORWARD is an economic-driven, bottoms-up analysis of the North American battery and fuel cell electric vehicle market—a one-stop resource combining first-hand industry knowledge of battery and fuel cell commercial electric vehicle market leaders with ACT’s expertise in analysis and forecasting to provide a first-of-its-kind business planning tool. By collaborating with nearly 50 of the leaders in battery and fuel cell technology for Classes 4-8 vehicles, ACT Research has developed an extensive and highly regarded report analyzing and forecasting adoption rates of 23 vehicle applications across North America through 2040. Recognized as the leader in CV demand forecasting, ACT Research has developed and aggregated information across North America on propulsion systems technology development covering battery and fuel cell electric powertrains, government regulations and subsidies, electric and hydrogen supply and infrastructure, and crafted a total-cost-of-ownership (TCO) model complete with three scenarios (base, slow, fast adoption) regarded by new and legacy OEMs, Tier 1 & 2 Suppliers, investment firms, and fleets as the best in the market.

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

08/03/23

According to ACT Research’s recently released edition of CHARGING FORWARD, a multi-client decarbonization study of the US commercial vehicle market, conversion of the CV sector will require a very coordinated effort between vehicle acquisition and the supporting charging infrastructure to ensure adequate charging infrastructure is in place to support fleet needs.

Typically, utilities have implemented programs to assist fleets in their infrastructure development, serving as project managers to assist the project from “pole to pad” or even “pole to plug” for participating fleets.

“Early adopters of battery-electric commercial vehicles experienced rather lengthy timelines to install EV charging infrastructure,” noted Ann Rundle, Vice President of Electrification & Autonomy with ACT Research. “Utilities have now been able to support timelines of nine to 13 months, from initial preliminary design to final design and construction, but those lead-times reflect adequate existing transformer capabilities. A more conservative rule of thumb indicates fleets should begin planning and coordinating behind-the-fence EV charging infrastructure to allow for an 18- to 24-month lead time.”

Rundle concluded, “If an area requires more extensive grid upgrades, increased lead times are needed, especially if they require additional levels of approval. Feeder upgrades could take more than a year. Substation upgrades could take one to two years. New substations could take three years or more, as this would encompass planning, load interconnection studies, and complexities in the permitting process.”

Is it worth the investment?

The perspective of OEMs, suppliers, new entrants, dealers, and fleets is essential for our continuously developing TCO and forecast models that provide unparalleled insight into the forecast trajectory of adoption and production of decarbonized commercial vehicles. That’s why we are developing the third edition of CHARGING FORWARD in 2023.

Get the analysis, here.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.