Charging Forward: 2024-2040 Decarbonization Forecast & Analysis

Ready to Charge Forward?

CHARGING FORWARD, ACT's commercial vehicle decarbonization forecast and report will be available for purchase starting July 10, 2023.

GET CHARGING FORWARDThe reports [ACT Research] has produced on electric vehicles were unbelievable, incredibly valuable, and we tell our customers, if you really want to go deeper into this conversation, go to [ACT Research].

Paul Rosa

Penske Transportation Solutions

Actionable Decarbonization Intelligence from an Industry Expert

WHAT IS IT?: 2024-2040 Commercial Vehicle Sales & Production Forecast

GEOGRAPHY?: Global (North America, Europe, China) or North America-only

MARKET COVERAGE?: Classes 4-8 (or global equivalent) Commercial Vehicles

POWERTRAIN COVERAGE?: Diesel vs. BEV, FCEV, NG, Gasoline, H2 ICE, and Hybrids

APPLICATIONS/DUTY CYCLES: More than 40, including:

- Class 8 Regional Truckload

- Class 8 Local Truckload

- Class 8 Long-Haul Truckload

- Class 8 LTL, Linehaul

- Class 8 Refuse Truck

- Class 8 Construction/Dump Truck

- Class 8 Local Distribution Truck

- Class 8 Yard Spotter

- Class 8 Transit Bus

- Classes 6-7 School Bus

- Classes 6-7 LTL Pick-up & Delivery

- Classes 6-7 Reefer Box Truck

- Classes 6-7 Utility/Lift Truck

- Classes 6-7 Beverage Truck

- Classes 4-5 Parcel Delivery Truck Short-Range

- Classes 4-5 Parcel Delivery Truck Long-Range

- Classes 4-5 Service/Utility/Work Truck

What does all this insight look like?

Download a sample of CHARGING FORWARD to see how the report and TCO model can support your business planning.

A powerful tool for all your strategic planning needs.

Since 2018, ACT Research has been developing and refining a bottoms-up analysis of the decarbonization market to support truck and tractor OEMs, suppliers, fleets, investors, infrastructure suppliers, and regulators to better understand and plan for the path to meeting zero-emission targets and goals as we approach 2040.

CHARGING FORWARD covers eight specific target areas to lay the foundation of our research and assumptions, including:

- Economic Assumptions and Analysis

- Market Overview

- Second Life Considerations

- Propulsion Systems Technology

- Government Regulations and Subsidies

- Infrastructure

- Fleet, Rental, and User Feedback

- Total Cost of Ownership

Adopted by at least one global truck OEM, one global Tier 1 supplier, and one rental and leasing company, our TCO-model has been a go-to tool for companies as they plan for the road ahead.

The way goods are moved around won't change because there are new ways to power trucks. However, when we think about how to make trucks produce less pollution, there are some big, long-term things we don't know yet that we need to remember.

The first thing is how the world is organized politically and economically. During the pandemic, we saw how making and moving things around can be hard when supply chains break. Trying to make things closer to home will help people who make and drive trucks because they will have more work.

Next, we need to think about how technology is changing. If we start using self-driving trucks, they could work longer hours and get more done. This will help the trucking industry, but it might mean we don't need as many new trucks as we used to. Self-driving trucks work best for long trips and big trucks that need a lot of energy.

Finally, we need to think about rules and laws. Some places, like Europe, are doing a lot to reduce pollution. Other places, like the U.S., aren't moving as quickly. Some places say they will improve things but haven't taken action yet. All these things can affect how much pollution trucks make in the future.

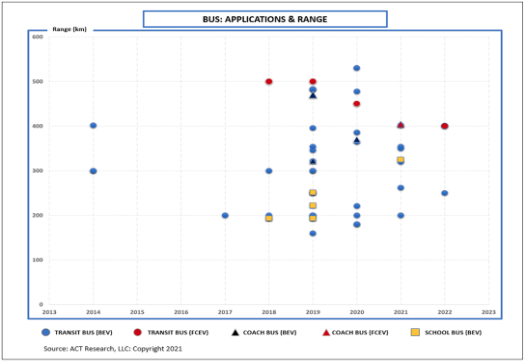

Different vehicle manufacturers, both established and new, have been working hard to develop various types of powertrains for commercial vehicles in the Classes 4-8 range. These powertrains include batteries, fuel cells, natural gas, hydrogen internal combustion engines, and hybrid systems, all aiming to meet zero-emission goals. The charts below show the vehicles that are currently in production and available today, along with their maximum range and the date they started production.

Heavy Duty Battery Electric and Fuel Cell Electric Vehicle Applications and Range:

Medium-Duty Battery Electric and Fuel Cell Electric Vehicle Applications and Range:

Bus Battery Electric and Fuel Cell Electric Vehicle Applications and Ranges:

Battery electric vehicles (BEVs) offer the most efficient solution compared to internal combustion engines (ICE) and fuel cell electric vehicles (FCEVs). BEVs have a fuel production efficiency of 95% and an overall efficiency of 73%. In comparison, fuel cell vehicles have a fuel production efficiency of 64% and an overall efficiency of 29%, while diesel ICE vehicles have a fuel production efficiency of 50% and an overall efficiency of 23%. The overall efficiency depends on factors such as duty cycles and environmental conditions, and improvements can be expected over time.

Although hydrogen fuel cell technology has made progress in reducing carbon emissions, the business case for fuel cells is not as advanced as batteries, which are viable for use today. Battery electric powertrains work well for shorter ranges and stop-and-go operations, while hydrogen-powered electrification is seen as a long-term solution for longer-haul heavy-duty applications. The focus of hydrogen adoption is on the cost, accessibility, and environmental impact of the fuel.

There are secondary challenges for hydrogen, including potential battery pack range and energy density breakthroughs. If these technologies improve, batteries may become more favorable than hydrogen for longer length-of-haul applications.

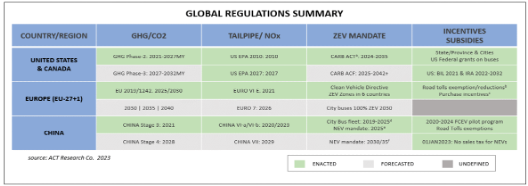

Government regulations and policies play a significant role in shaping the adoption of commercial electric vehicles (CEVs). Regulations for ICE vehicles will increase costs, while greenhouse gas (GHG) and carbon dioxide (CO2) regulations will require electrified propulsion. Policies will provide incentives and subsidies for CEVs, and zero-emission mandates will require a certain percentage of CEV/FCEV adoption. Stricter regulatory standards for ICE vehicles will make the total cost of ownership more favorable for CEVs, encouraging buyers to choose CEV alternatives.

Battery-electric powertrains have specific strengths that are beneficial for vehicles with duty cycles involving intermediate daily ranges, lower-speed operations, highly regular routes, stop-and-go driving profiles, and the ability to return to a base for overnight charging.

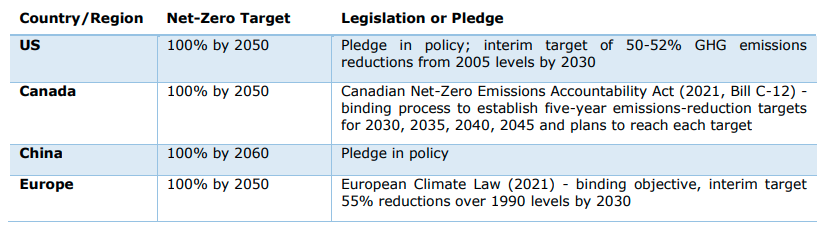

In 2016, 191 countries and the European Union made commitments in the Paris Agreement to address long-term climate goals. These countries are taking steps to reduce their emissions and work towards achieving net-zero emissions.

119 countries have set targets for achieving net-zero emissions, although only 18 have turned these targets into laws. The net-zero targets vary across different regions of the world.

Regulations, subsidies, and incentives are significantly shaping the market for commercial vehicles (CVs) until 2050. However, the level of strictness in reducing CO2 and tailpipe emissions and the requirements for zero-emission vehicles (ZEVs) vary among countries. Despite these differences, regulations are important drivers pushing the adoption of commercial vehicles that do not emit greenhouse gases (GHGs), CO2, NOx, and other pollutants. ZEV mandates are also influencing the market for cleaner commercial vehicles.

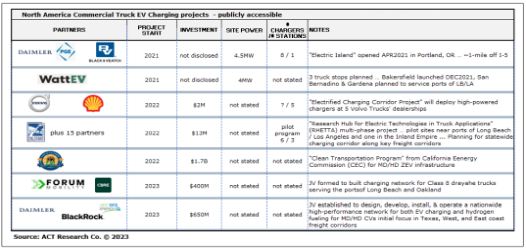

Infrastructure is a major concern for electric vehicles (EVs), and two key questions arise: Will there be enough electricity generation capacity to meet the growing demand for EV charging? And will this electricity come from renewable sources? While these questions are still to be fully answered, original equipment manufacturers (OEMs), infrastructure suppliers, and charging companies have been actively involved in projects and initiatives to address the infrastructure needs of the transportation industry.

In North America, nearly 75% of commercial vehicle applications operate on a "return to base" duty cycle. This means that charging can be conveniently done during off-shift hours. While most Class 8 tractor sleepers and about 5% of Class 8 tractor day cabs do not return to base, vehicles such as school buses, refuse trucks, utility vehicles, and work trucks typically operate on a single shift. This leaves ample time for charging while these vehicles are parked at the depot. However, the infrastructure questions remain. Can the grid handle the increased demand, and will the electricity used be sourced from renewable and environmentally friendly options, especially when 75% of applications can potentially be charged?

When it comes to long-haul Class 8 tractors, various initiatives like the National Electric Vehicle Infrastructure (NEVI) program have been implemented. This program provides funding to states to establish EV charging stations and interconnected networks, facilitating data collection. The ultimate goal is to create a nationwide network of 500,000 EV charging locations along major highways and throughout communities across the United States. This network aims to support and enable long-distance driving with electric vehicles.

Truckers and fleets purchase trucks to make a profit. These vehicles are crucial for various industries, such as beverage delivery, electricians, refuse management, and long-haul transportation. Therefore, the economics of vehicle purchases must favor the fleet over time. When assessing the total cost of operating trucks or buses from a powertrain perspective, several factors come into play:

- Regulations and incentives

- Initial purchase costs

- Fuel and emissions fluids

- Maintenance costs

- Insurance costs

- Charging infrastructure investments

- Road usage taxes for zero-emission trucks

- Battery replacement

- Fuel cell replacement

- Taxes

- Weight and function considerations

To support a comprehensive analysis of payback and help companies develop a strategic business plan, ACT Research has created a total-cost-of-ownership (TCO) model. This model takes into account these factors along with additional considerations. Its purpose is to assist companies in achieving their zero-emission goals set in the Paris Agreement of 2016, complying with national regulations and mandates, taking advantage of subsidies and incentives, and ensuring financial viability for their operations.

Download a sample of the TCO model to get a first-hand look at how ACT Research has developed our model.