About Us

Our Story: Continuity, Innovation, Partnership

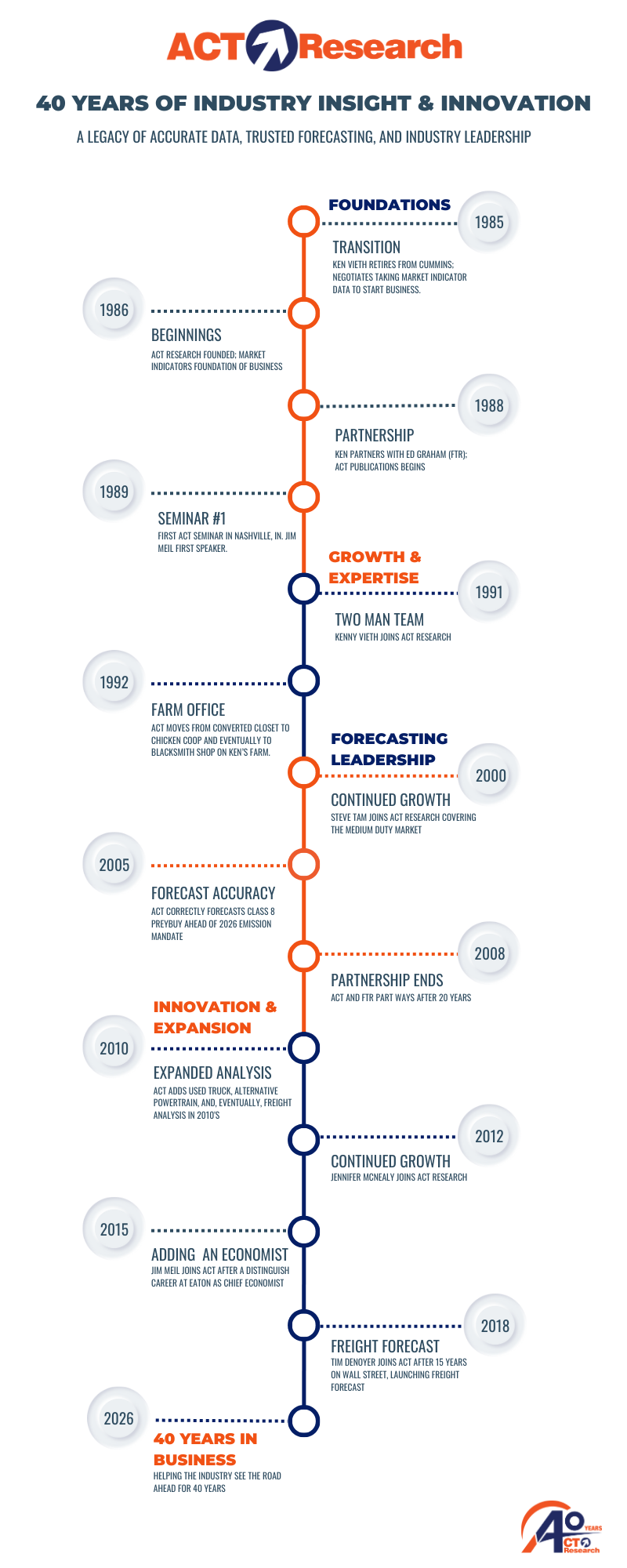

For 40 years, ACT Research has been the trusted source for economic insights in the commercial vehicle industry. Our team of economists, analysts, and researchers remains committed to delivering dependable, actionable intelligence; helping our clients plan for tomorrow with confidence.

ACT Research History - 40 Years of Helping the Industry See the Road Ahead

Founded in 1985 with a simple goal — bring clarity to a complex market — ACT Research has stood at the crossroads of every major transformation in commercial vehicles and freight. We’ve seen deregulation reshape trucking, supply-chain shocks recalibrate demand, and today we’re preparing fleets, OEMs, suppliers, investors and new market entrants for the electrification, autonomy and decarbonization frontier.

Methods evolve. Integrity endures. Our tools have changed but our purpose remains the same: help you make the right decisions today, for tomorrow’s market.

The Founding Years: 1985–1989

Amidst the post-deregulation turbulence of the early 1980s — when OEMs like GM exited heavy trucks and industry optimism waned — Ken Vieth saw opportunity in data. After retiring from Cummins in 1985, he founded ACT Research, with a focus on transparency and tactical market data. Teaming up with Ed Graham (FTR) in 1988, ACT Publications emerged as a fusion of tactical insights and strategic outlook. The first ACT seminar in 1989 created a new forum for industry dialogue, bringing together OEMs, suppliers, and investors.

Growth & Grit: The 1990s

The 1990s ushered in OEM consolidation and intermodal growth, with Freightliner aggressively acquiring share under Jim Hebe. ACT mirrored the industry’s expansion: Kenny Vieth, Ken’s son, joined the company in 1991, and the office expanded from a closet to converted outbuildings on Ken’s farm, like the chicken coop and blacksmith shop. Eric Starks joined in the mid-90s, and by 1998, Joyce Wire came aboard, helping bring greater operational sophistication. By decade’s end, ACT’s seminars were gaining attention and attendance, mirroring the firm’s rising influence.

Digital Leap & Product Expansion: The 2000s

The 2000s saw the emergence of ACT as a digital-forward firm. Steve Tam joined in 2000, and Dan Lucas became ACT’s first remote economist. Transitioning from manual fax distributions to email and PDFs, ACT modernized delivery and broadened reach. New product lines emerged, including one of the industry’s first used truck market datasets. ACT’s accurate forecasts around the EPA 2007 emissions prebuy highlighted its growing authority in commercial vehicle forecasting. After 20 years, ACT Research and FTR ended their partnership in 2008.

Consolidation & Specialization: The 2010s

Throughout the 2010s, ACT expanded its specialization, integrating more granular forecasting tools and increasing seminar participation. The company enhanced its staffing, digital infrastructure, and content sophistication. As customer expectations for forward-looking insights grew, ACT stayed ahead with its signature mix of data integrity and economic acumen as Jennifer McNealy, Debby Steinbarger, Frank Maly, Sam Kahan, Jim Meil, and Tim Denoyer all joined the team during this period.

Market Leadership & Innovation: The 2020s

Today, ACT Research is widely recognized as the industry’s trusted source for commercial vehicle market forecasting. From pioneering remote work in the early 2000s to offering real-time, digitally delivered insights, ACT continues to lead with innovation that includes rate forecast across on-highway sectors, alternative powertrain and autonomous market deep dives, used truck price forecasting, and coverage of the Mexico trailer market. Its freight and used truck data products have emerged as industry benchmarks, while its seminars attract a diverse set of OEMs, suppliers, fleets, financial professionals, and other industry players. As ACT’s influence expanded, so too did its team, with the addition of Carter Vieth, Ann Rundle, Lydia Vieth, Colleen Weaver, Margie Dasovich, Amanda Williams, Bailey Schnur, Josh Robinson, and Kiley Broad – brining fresh insights and talent to fuel the company’s continued growth. The legacy that began with one man’s vision, a converted closet, and a fax machine now supports and informs decision-making across North America’s transportation economy.

History in Motion: ACT Research and the Evolution of Commercial Vehicles

A Turning Point for Trucking

Trucking & Commercial Vehicles in the 1970s

The Deregulation Roots of ACT Research

Chaos to Clarity

The Late 1980s Trucking Environment

From Deregulation to Overcapacity

ACT Research is Born

1986

ACT's Inaugural Seminar

The Beginning of a Tradition

We Provide Businesses with Data and Analysis

We provide regularly updated forecasts of N.A. Classes 5-8 vehicles, China commercial vehicles, Classes 5-8 on-highway engines, and freight rates and volumes.

We produce regular market data reports and databases covering N.A. Classes 5-8 vehicles, U.S. used trucks (Classes 3-8), U.S. trailers, the economy, and other market segments.

We work with industry players to help them answer their biggest questions. Need custom analysis or non-obvious insights? Our expertise is your advantage.

250+ Combined Years of Experience

Our team is a trusted and experienced collective of commercial vehicle and transportation professionals.

#1 Award Winning Forecasters

Awarded the 2019 Lawrence R. Klein Award for Forecast Accuracy

18 Monthly and/or Quarterly Reports

Publishing multiple monthly and quarterly reports and databases for the benefit of our clients and the market.

We provide data and information that is critical to understanding the markets and their future.

Get the information your business needs. You depend on data. Depend on ACT Research.

Awards & Recognition

- 2019 Lawrence R. Klein Blue Chip Award for Forecast Accuracy 2015-2018

- Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast

- Consulting Economist to the National Private Truck Council

- National Excellence Wall Street Journal Top Economic Outlook

- USA Today Top 10 Economic Forecasters

I would recommend ACT Research to anyone that’s looking for in-depth insight into what’s happening in the commercial vehicle markets. The expertise and knowledge that goes into the service they provide, there’s not a better solution, in my opinion, for commercial vehicle data than ACT Research.

Jeff Trent

Marketing Director

Trusted Partner & Contributor of Leading Institutions

Finger On The Pulse

ACT Research has its “finger-on-the-pulse” of the commercial vehicles industry like few others. As the trusted partner of LMC Automotive, DAT Freight & Analytics, and Escelant [Rhein Associates], and contributor to the Blue Chip Financial and Wall Street Journal Consensus Economic Forecast, we provide keen insights on benchmarks, market share analysis, short- and long-term strategic planning, and capacity planning because of our deep understanding of the vehicle demand cycle. As a contributor to The Blue Chip Economic Indicators, ACT was awarded the 2019 Lawrence R. Klein Award for the most accurate economic forecast from 2015-2018.

ACT Research is recognized as the leading publisher of commercial vehicle (CV) industry data, market analysis, and forecasting services for the North American market. The ACT Research staff is committed to data quality & integrity, in-depth analysis, and timeliness. Our winning forecast is recognized as the industry standard.

Founded in 1986 with the goal of improving and expanding North American commercial vehicle analysis in order to promote a better understanding of the transportation industry, ACT Research is highly regarded as the “go-to” firm for market data and analysis. By working directly with commercial vehicle manufacturers, ACT Research collects and confidentially shares timely market and performance data that provide a comprehensive look at the industry’s past and present performance, with an in-depth analysis of future expectations. Our analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as fleets, new market entrants, infrastructure suppliers, banking, and investment companies.

Our staff includes experts in the commercial vehicle and transportation industry and award-winning economists. Additionally, we’ve developed strategic alliances with experts that increase our ability to provide value-added services to our clients.